#ReachThoseGoals: What’s up with credit scores? (And why should I care?)

In this article, we’ll dig into credit scores: what the heck they are, why they matter, and what they’re made of. After reading this article, you’ll be halfway through our six-part series. Given you’ve made it this far, we want to commend you for putting in the work to take control and become more educated about your finances. That in and of itself is worth celebrating. Whatever your goals, wherever you are, you’ve got this. And we’ve got you.

In today’s world, having access to credit is very important. It can be used to contribute to big purchases like buying a car or funding your education, or even smaller purchases such as a cellphone plan, which may not accept cash or debit cards. As we know, before you can get credit, lenders – like banks and other financial institutions – need to get some assurance that you’ll be able to keep your commitment, and pay back what you borrow. So, how is it they determine that? Let’s take a look.

How do lenders determine if they can “trust” you?

Credit Report

-

A detailed breakdown of your credit history. It lists whether you have missed a payment on a credit card, when you have applied for a card, etc.

Credit Score

-

A number assigned to a person that indicates to lenders their capacity to repay a loan. It takes all the data from the credit report and puts it into a number.

Two ways:

-

Credit report: A detailed breakdown of your credit history. Your credit report lists your activity with credit like when you’ve made on-time payments on a credit card or have applied for a credit card. Think of it like your own personal biography page of your credit activity.

-

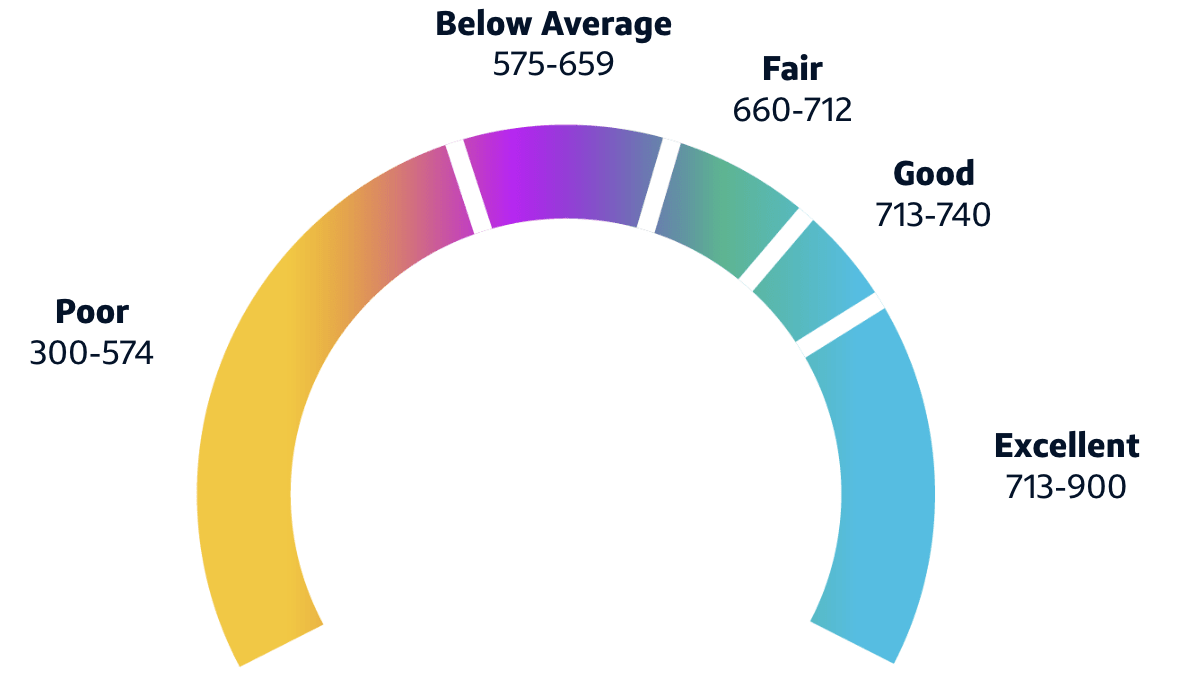

Credit score: A number assigned to a person that represents their ability to repay a loan. For Canadians, this number ranges from 300 to 900. Your credit score takes all the data from the credit report and puts it into a number that quantifies your level of creditworthiness.

Naturally, having a good credit score matters, because it determines if you will qualify for credit at all. But there’s more to it than that. Your credit score also determines what interest rate you’ll pay on your credit. If lenders feel confident they’ll get their money back, they don’t need to protect themselves by motivating borrowers to pay back what they’ve borrowed with a high interest rate. Beyond interest rates, a healthy credit score will open other doors, like when you’re looking to rent an apartment, since landlords use it to evaluate your financial stability.

With all that in mind, it’s important to know how you’re being “marked” for your score, and how it breaks down...

Credit scores range from 300-900. Anything above 740 is typically considered to be excellent. So, how does yours get calculated? Below are some of the factors that are taken into consideration.

How do credit scores range?

Your payment history

Hot tip: It’s better to pay the minimum per your agreement, as opposed to paying more money even a day late. Banks’ best customers can be the ones who pay the minimum for decades. Being reliable and on time counts. Your cell phone bill counts, too.

Your card’s “utilization”

Hot tip: Utilization is basically how much of your credit you’ve used vs. how much is available. Keep your utilization percentage under 30%. For example, if you have $1,000 available to you on your credit card, try to keep what you use, or what you owe, under $300.

Your credit history

Hot tip: Hold on to credit cards you’ve had for a long time. If you cancel a credit card you’ve had for 20 years, for example, it will decrease the amount of credit available to you, which would then up your “utilization” ratio. For example, if that card had $1,000 credit limit, if you cancel it, that’s $1,000 less towards the percentage of what you’re using vs. what’s available.

Public records

Hot tip: This accounts for any bankruptcy filings, foreclosures, or delinquency

Inquiries

Hot tip: This covers applications for new credit cards or loans.Soft credit checks (not tied to a specific application for credit) do not impact your credit score. Hard credit checks (when applying for specific credit products) do. With services like Quick Check®* from Capital One, you can check if you’ve been pre-approved for a credit card with no impact to your credit score.

Credit is an important part of unlocking essential things in life. It can fluctuate over time, and regardless of what happens, it can always be built or rebuilt upon. Wherever you’re at on your credit journey today, Capital One is by your side to take on tomorrow. You’ve got this. We’ve got you. Now, ready for the next article? Let’s do this.

* If Quick Check pre-approves a card, you can be sure we’ll approve your application as long as:

a. There’s been no change in your credit file information, personal information or financial status from the time you receive your Quick Check results to the time you apply for one of our credit cards;

b. You’re at least the age of majority in the province or territory you live in;

c. Your application isn’t flagged for fraud prevention;

d. You don’t have an existing Capital One account; and

e. You haven’t applied for a Capital One account in the last 30 days or had an account with us that was not in good standing in the last year. In good standing means not past due, over limit, fraudulent, restricted, or part of a consumer credit counselling program or bankruptcy.

In some cases, we may not be able to open an account for you even though your application was approved. This can happen if we’re unable to verify your identity, or you don’t provide the required security funds if you’re approved for a Secured Mastercard®.